Manufacturing supplies are items used in the. Office supplies are items used to carry out tasks in a companys departments outside of manufacturing or shipping.

Adjusting Entries For Asset Accounts Accountingcoach

The income statement account Supplies Expense.

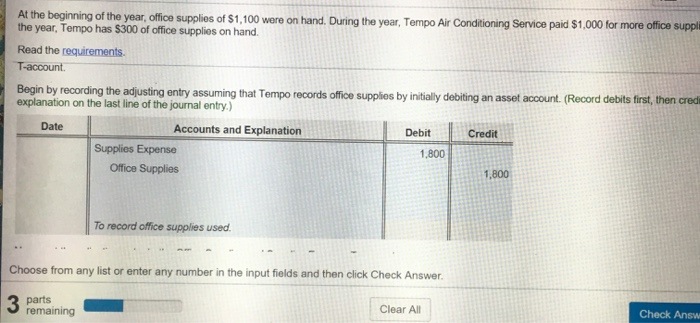

. Supplies are items your business uses for day-to-day operations such as pens sticky notes and printer ink. A debit Supplies Expense 3 900. B debit This problem has been solved.

Shipping supplies are the cartons tape shrink wrap etc. Office supplies used Beginning office supplies Bought-in office supplies Ending office supplies Office supplies used 1000 800 500 1300 Likewise the company ABC can make the journal entry for 1300 of the office supplies used during the period as below. At the end of the accounting period a physical count of office supplies reveled 1600 still on hand.

Your business is taxed on supplies but not inventory. The Supplies account contains the value of general office or warehouse supplies such as pens paper and notebooks. For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total amount of 50 and pays for the items with cash.

Quirk Company purchased office supplies costing 3000 and debited office supplies for the full amount. If the cost of the supplies that you have purchased and not yet consumed is significant then you can instead record them as. The appropriate adjusting journal entry to be made at the end of the period would be a Debit Office Supplies Expense 1600.

Supplies Accrual Accounting Method play-rounded-fill. Supplies can be considered a current asset if their dollar value is significant. This is the starting point for making an adjustment entry for supplies on hand.

Credit Supplies 3 900. The adjusting entry for Supplies in general journal format is. A debit is the left-hand side of a t-account Willow Rentals purchased office supplies on credit.

Office Supplies An Explanation. Given the fact that there is a multitude of items included in the office supplies it is hard to keep accounts and manage inventory for all of them individually. When an item is actually used in the business it becomes a supplies expense.

Company ABC plan to pay the 2500 at a later date. If your supplies and inventory become hard to manage you might even consider hiring a supply chain consultant. The business would then record the supplies used during the accounting period on the income statement as Supplies Expense.

Popular Double Entry Bookkeeping Examples. Supplies on hand are shown on the balance sheet of the business as a. The original journal entry will show a debit in the supplies column and a credit in the cash column.

The general journal entry made by Willow Rentals will include. Credit to accounts payable account that is classified as an asset in a companys chart of accounts accounts receivable A debit is used to record an increase in the dividends account. Supplies on hand at the end of the accounting period were 1300.

All of these items are. To balance the equation the supplies expense in the income statement reduces the net income retained earnings and therefore the owners equity in the business by the same amount of 150. Similarly is supplies on hand an asset.

Notice the amounts in each account. The normal accounting for supplies is to charge them to expense when they are purchased using the following entry. For preparing products that are being shipped to customers.

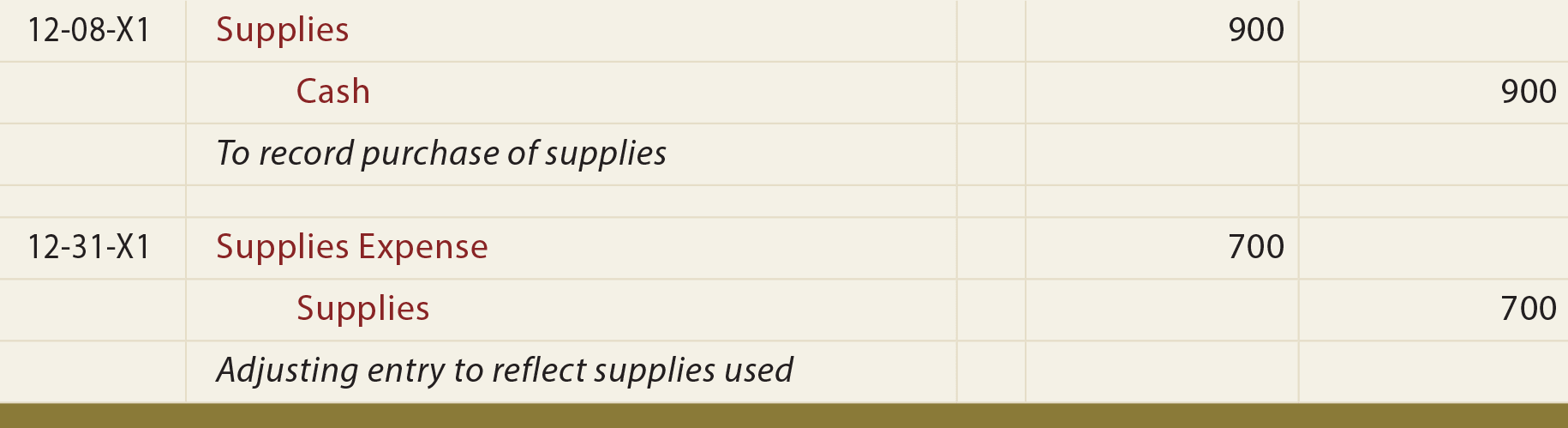

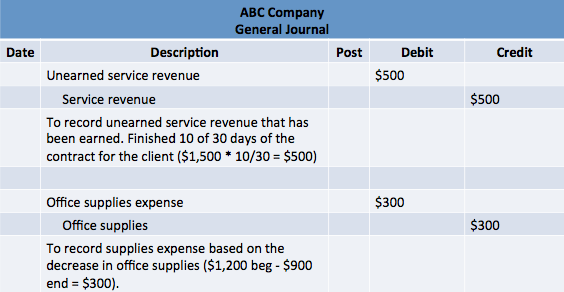

At the end of the accounting period a physical count of office supplies revealed 900 still on hand. Supplies Accrual Accounting Method Concept 1. Office supplies expenses include items such as staples paper ink pen and pencils paper clips binders file folders and markers.

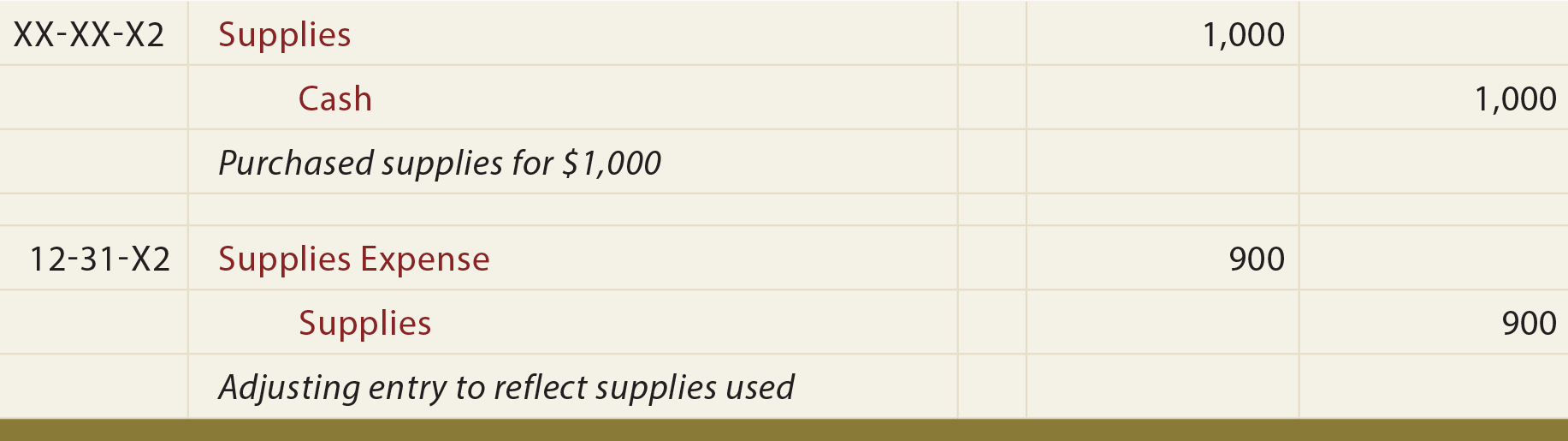

Balance the entry by crediting your supplies account. For example if you used 220 in supplies debit the supplies expense for 220 and credit supplies for an equal amount. For example a 1500 credit in the cash column should correspond with a 1500 debit in the supplies column.

Supplies consumed 1500 500 1000 2000 Likewise we can make the journal entry for supplies consumed at the end of the accounting period by debiting the 2000 into the supplies expense account and crediting this same amount into the supplies account. Paid Cash for Supplies Journal Entry Example. Therefore there is a need to club all these items under one heading and ensure.

The appropriate adjusting journal entry to be made at the end of the period would be. In this case on the left hand side of the accounting equation the asset of supplies on hand decreases by 150. Ignatenko Company purchased office supplies costing 5000 and debited the supplies account for the full amount.

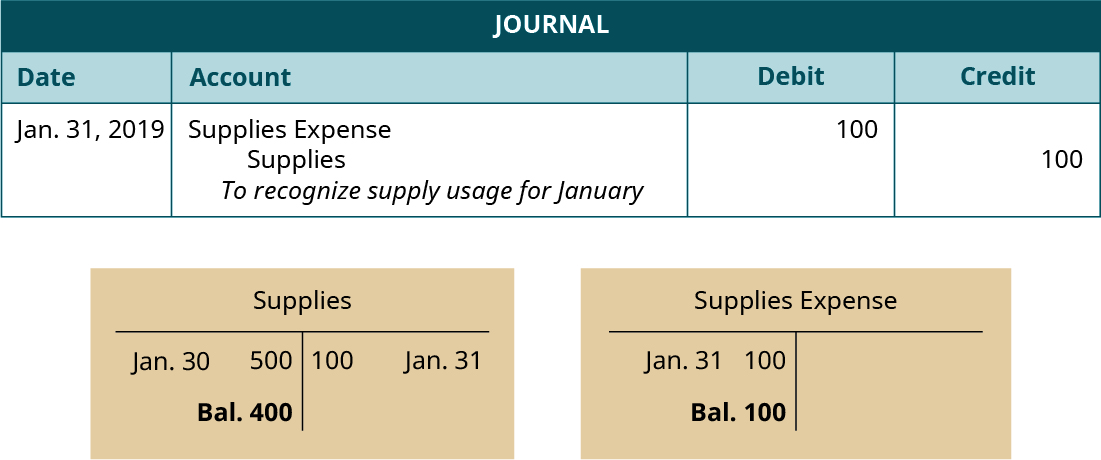

If the cost is significant small businesses can record the amount of unused supplies on their balance sheet in the asset account under Supplies. Company ABC purchased Office supplies on account costing 2500. Notice that the ending balance in the asset Supplies is now 725the correct amount of supplies that the company actually has on hand.

See the answer Show transcribed image text Expert Answer. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry. Inventory refers to items your business sells to consumers.

We adjust the account for the amount of supplies used up during the period. Office supplies are likely to include paper printer cartridges pens etc. Office Supplies include copy paper toner cartridges stationery items and other miscellaneous desk supplies.

At the end of the year the following journal entries are created in case there are office supplies present on hand. Office Supplies Expense Prepaid Conclusion Therefore to sum up the options made above show that office supplies are goods used by the company to carry out basic functions.

Solved At The Beginning Of The Year Office Supplies Of Chegg Com

Supplies On Hand Archives Double Entry Bookkeeping

Supplies On Hand Archives Double Entry Bookkeeping

The Adjusting Process And Related Entries Principlesofaccounting Com

The Adjusting Process And Related Entries Principlesofaccounting Com

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

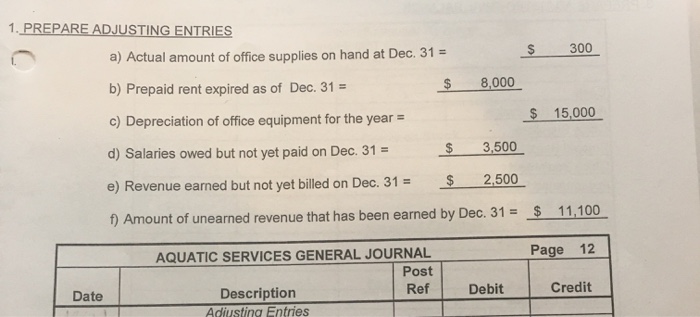

Solved Prepare Adjusting Entries A Actual Amount Of Office Chegg Com

0 comments

Post a Comment